A Complete Guide to Buying, Selling, Renting, and Investing in Landed Properties in Singapore

Landed properties in Singapore represent a highly sought-after segment of the real estate market, offering unique opportunities for affluent homeowners, discerning investors, and those aspiring to elevate their residential experience. This comprehensive guide serves as an in-depth resource for understanding the intricacies of acquiring, divesting, leasing, or investing in landed properties within Singapore’s unique regulatory and market context.

Introduction to Landed Properties in Singapore

Landed properties in Singapore are residential assets wherein the property owner retains both the land and the dwelling situated on it. Key categories of landed properties include terraced houses, semi-detached houses, bungalows, and Good Class Bungalows (GCBs). Unlike strata properties such as condominiums, landed properties confer exclusivity, substantial privacy, and expansive living environments, which makes them a coveted asset class.

Types of Landed Properties

- Terraced Houses: Properties that share common walls with adjacent units in a continuous row, providing a compact yet functional housing solution.

- Semi-Detached Houses: Dwellings that share a wall with one neighboring unit, offering increased privacy and larger lot sizes relative to terraced houses.

- Bungalows: Independent properties that do not share walls with other units, offering maximum privacy and significant outdoor space.

- Good Class Bungalows (GCBs): The epitome of exclusivity and luxury in the Singaporean housing market, GCBs are characterized by their expansive land parcels and prestigious locations, typically in affluent neighborhoods.

Can Foreigners Buy Landed Property in Singapore?

Foreign ownership of landed property in Singapore is subject to stringent regulations. Foreign nationals seeking to purchase landed property must obtain approval from the Singapore Land Authority (SLA), with Sentosa Cove being one of the few areas where such purchases are typically permitted. Eligibility hinges on the demonstration of significant economic contributions to the nation and a commitment to owner-occupancy for a specified duration.

HDB Upgrading to Landed Property

HDB (Housing and Development Board) homeowners contemplating an upgrade to landed property must carefully evaluate the financial, regulatory, and logistical aspects of such a transition. The upgrade involves considerable financial commitments, including increased down payments, higher property taxes, and substantial maintenance expenditures. Understanding the Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR) is critical for assessing financial feasibility and ensuring sustainable homeownership.

Buying Landed Property in Singapore

Purchasing a landed property in Singapore constitutes a substantial financial undertaking and requires nuanced knowledge of the market and regulatory landscape. Whether the goal is to acquire a new landed property in Singapore or one within a specific budget such as a landed property less than 2 million, the acquisition process requires a methodical approach.

Types of Landed Property for Sale in Singapore

Landed properties for sale span a broad spectrum in terms of pricing, tenure, and features. Buyers can choose between freehold and leasehold options, with each having distinct advantages and limitations.

- Freehold Landed Properties: Offering perpetual ownership, freehold properties, including the cheapest freehold landed property in Singapore, are highly valued for their long-term security and potential for capital appreciation, albeit often accompanied by a higher price tag.

- Leasehold Landed Properties: Typically available on 99-year or 999-year leases, leasehold properties provide a more affordable entry point into the landed property market, though the lease expiration is a limiting factor in terms of long-term ownership value.

Factors to Consider When Buying

- Price Index: The Singapore landed property price index offers critical insights into prevailing market trends and pricing dynamics, which are essential for informed decision-making.

- Location: Location remains a pivotal determinant of property value, with areas such as Orchard Road and Bukit Timah commanding premium prices due to their centrality and access to amenities, whereas suburban locations may offer enhanced value-for-money.

- Down Payment Requirements: The landed property down payment for Singapore citizens typically ranges between 20% and 25% of the property value, with foreign buyers often subject to more stringent requirements.

- Property Tax: Landed property tax in Singapore is calculated based on the annual value of the property and varies depending on whether the property is owner-occupied or rented out.

Steps in the Buying Process

- Budgeting and Financial Planning: Assess affordability, evaluate mortgage eligibility, and determine down payment requirements.

- Property Search: Utilize online platforms and engage real estate agents to identify suitable landed properties for sale in Singapore.

- Due Diligence: Perform thorough property inspections, assess structural integrity, and ensure compliance with regulatory requirements.

- Offer and Negotiation: Submit a formal offer to the seller and negotiate the purchase price.

- Legal Procedures and Loan Arrangement: Secure financing, engage a conveyancing lawyer, and finalize the necessary legal documentation.

Selling Landed Property in Singapore

Market Analysis and Trends

To successfully market a landed property, it is imperative to understand current Singapore landed property price trends. Monitoring landed property transactions in Singapore offers insight into prevailing market conditions, enabling sellers to set competitive pricing.

Preparing Your Property for Sale

Optimizing a property’s appeal to prospective buyers requires careful preparation, including essential repairs, decluttering, and home staging. Leveraging professional photography and drafting compelling online listings are instrumental in capturing buyer interest.

Legal and Financial Aspects of Selling

- Stamp Duty: Seller’s Stamp Duty (SSD) may apply if the property is sold within a stipulated period after acquisition, influencing the net returns from the sale.

- Agent Services: Engaging an experienced real estate agent can significantly streamline the sale process by providing market expertise and expert negotiations.

Steps in the Selling Process

- Valuation: Obtain a professional appraisal to establish the property’s market value.

- Listing and Marketing: Advertise through multiple channels, including property portals and real estate agencies.

- Negotiation: Conduct price negotiations and agree on a sale price with prospective buyers.

- Legal Documentation: Execute the Sale & Purchase Agreement and facilitate conveyancing processes.

Renting Landed Property in Singapore

Renting a landed property offers an attractive option for those seeking temporary residence with greater space and privacy without the burdens of ownership.

Landed Property for Rent in Singapore: Overview

Rental rates for landed properties are influenced by property type, location, and amenities. Prime locations such as Orchard, Holland Village, and Sentosa command premium rental prices.

Factors to Consider When Renting

- Rental Duration: Lease periods typically span at least one year, with longer tenures often providing rental rate stability.

- Location and Amenities: Proximity to international schools, public transportation nodes, and community amenities are critical factors influencing rental decisions.

- Maintenance Responsibilities: Tenants are generally responsible for minor repairs and maintenance; thus, maintenance costs should be accounted for within the rental budget.

The Renting Process

- Property Search: Utilize property portals and engage real estate agents to identify suitable landed properties for rent in Singapore.

- Lease Negotiation: Negotiate lease terms, including rent, maintenance obligations, and lease duration.

- Security Deposit: Pay a security deposit, typically amounting to one to two months’ rent.

Legal Requirements for Renting

- Tenant Rights: Tenants are entitled to privacy and have the right to occupy the property without undue interference.

- Landlord Obligations: Landlords are responsible for ensuring that the property is safe, habitable, and compliant with agreed contractual terms.

Investing in Landed Property in Singapore

Investing in landed property represents a lucrative opportunity for wealth accumulation, driven by limited supply and consistent demand. Nevertheless, this venture demands substantial financial outlay and strategic planning.

Why Invest in Landed Property?

- Limited Supply: Constituting approximately 5% of Singapore’s residential market, landed properties are inherently scarce, supporting long-term value appreciation.

- Capital Appreciation: Historically, freehold landed property in Singapore has demonstrated significant capital gains, enhancing its attractiveness as an investment.

- Rental Income: Renting out landed properties can generate stable income, particularly in areas with high rental demand.

Strategies for Investing

- Long-Term Capital Growth: Holding properties over extended periods to capitalize on appreciation trends.

- Rental Yield: Acquiring properties in high-demand areas such as Bukit Timah to benefit from favorable rental yields.

- Renovate and Sell: Purchasing undervalued properties, executing targeted renovations, and selling for profit, while considering landed property taxes and renovation costs.

Affordable Investment Options

- Landed Property Less Than 2 Million: Although typically priced at a premium, there are landed property opportunities within the $2-3 million quantum.

Risks of Investing

- High Initial Capital Requirement: Landed properties demand significant upfront investment compared to other residential categories.

- Market Volatility: Economic downturns can impact property valuations and rental demand.

- Land Tax vs Property Tax: Differentiating these is vital for calculating overall holding costs and determining investment viability.

Case Studies of Successful Landed Property Investments

Case studies illustrating successful investments in areas like Bukit Timah provide practical examples of capital growth and rental income potential.

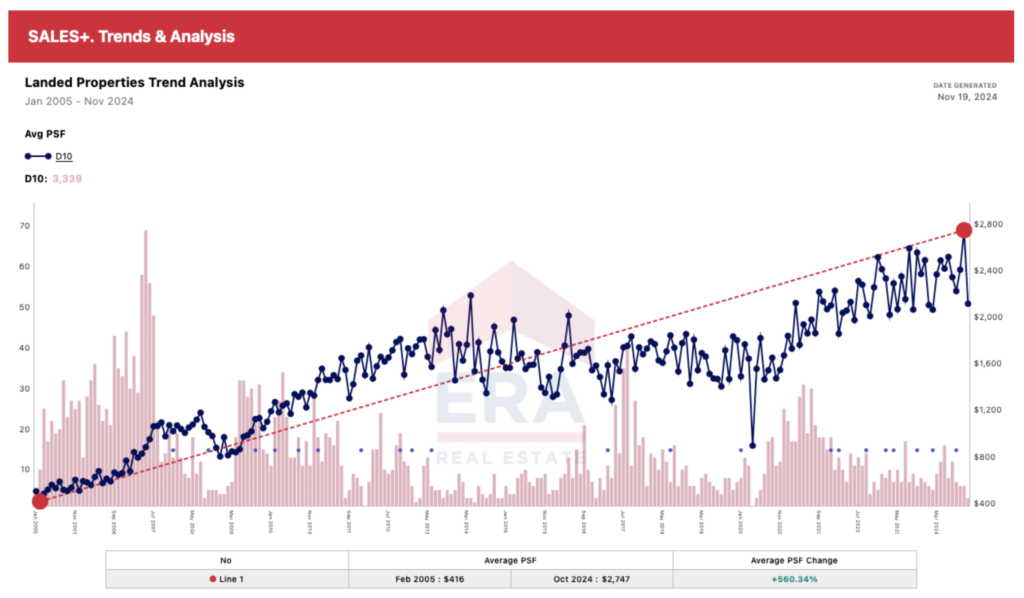

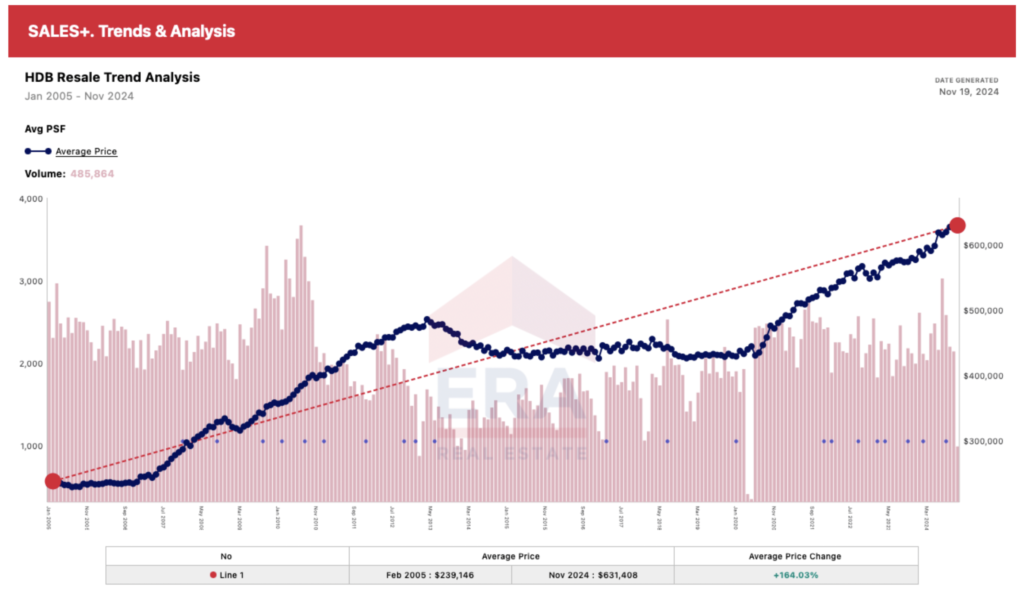

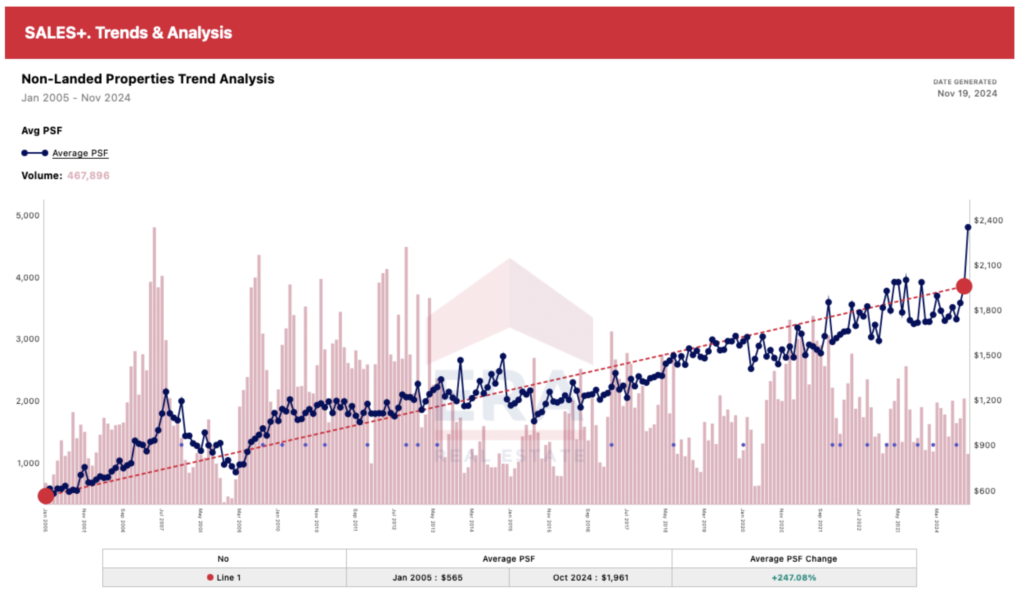

For instance, in District 10 (Bukit Timah), property prices increased by over 560% from $416psf to $2747psf between 2005 and 2024. Comparatively, HDB and private condominium prices rose by only 164% and 247%, respectively, showing that landed properties outpaced other property types significantly.

In contrast, across the same 20 years time frame, HDB prices and private condominium prices have only increased by 164% and 247%.

This shows that landed properties have increased 4x more than HDBs and 2.2x more than private condominiums.

Comparison with Other Property Types

- Landed vs Condo: While Condominiums in Singapore offer shared amenities, landed properties provide exclusivity, privacy, and space. A comparative analysis helps investors make informed choices regarding their asset allocation.

Landed Property Trends and Future Prospects

Current Trends

- Demand for Freehold Properties: Freehold properties continue to attract significant demand due to their enduring value.

- New Developments: Emerging developments incorporate sustainable and eco-friendly features to appeal to environmentally conscious buyers.

Government Policies and Impact

Government interventions, including foreign ownership restrictions and property tax regulations, significantly shape the landed property market landscape. Staying informed on policy shifts is essential for potential buyers and investors.

Market Outlook

The Singapore landed property price index is projected to maintain an upward trajectory, driven by constrained supply and consistent demand. Prospective buyers seeking affordable landed properties in Singapore are advised to act decisively in light of rising prices.

Future Prospects and Upcoming Areas

- Neighborhood Profiles: Detailed profiles of neighborhoods such as Bukit Timah, Sentosa Cove, and Serangoon Gardens provide a nuanced understanding of amenities, educational institutions, and average pricing, helping investors identify promising opportunities.

- Economic Trends: Factors such as interest rates and GDP growth have a profound impact on property prices, necessitating close monitoring by prospective investors.

Common Mistakes and FAQs

Common Mistakes to Avoid

- Underestimating Costs: Buyers often overlook the total costs of ownership, including maintenance, property taxes, and renovation expenses.

- Ignoring Location Factors: Neglecting future infrastructural developments or proximity to amenities can detract from long-term property value.

- Excessive Leverage: Over-leveraging to acquire property can lead to financial vulnerability, particularly in a downturn.

Frequently Asked Questions

- Can Foreigners Buy Landed Property in Singapore? Foreigners can buy landed property under specific conditions, subject to SLA approval.

- What is the Difference Between Land Tax and Property Tax? Land tax pertains to undeveloped land, whereas property tax is assessed based on the annual value of the developed property.

- What is the Down Payment Requirement for Landed Property? Generally, down payments range from 20% to 25%, with additional requirements for foreign buyers.

Navigating the landed property market in Singapore presents complexities due to high capital requirements and regulatory constraints. However, with well-researched strategies—whether buying, selling, renting, or investing—landed properties can be a compelling avenue for wealth creation and achieving an elevated living experience.

From understanding landed property taxes in Singapore to selecting the most suitable landed property for sale, this guide aims to provide the foundational knowledge required for informed decision-making.

For personalized advice and expert assistance in buying, selling, renting, or investing in landed properties in Singapore, feel free to reach out to me. I’m here to help you make confident and informed property decisions.